USDJ is the new stablecoin that TRON has been pushing lately. What is it exactly and how does it differ from the USDT-TRON (TRC-20 USDT) that we already have so far? In this guide, we will look into USDJ and all the other terms related to it. We will be using real-life examples and terms that you are already familiar with to make it easier for you to understand everything better.

The traditional stablecoins are mostly Fiat (government-issued currency) collateralized.

Collateralized simply means to provide something as collateral for (a loan). For example, when you want to get a loan from a bank and you already owned a property, the bank will likely request your property as collateral. In other words, the loan is collateralized by your property. Your property is pledged as security for the repayment of a loan.

USDT VS USDJ

Now let’s get back to Fiat-collateralized. Take USDT for example, for every 1 USDT that exists in the market, an equivalent of 1 USD will be stored in the Tether bank reserve. Although this method sounds simple and robust, it requires a central party that guarantees the issuance of the stablecoin. Regular audits are also needed to ensure that the stablecoin is indeed fully collateralized and the USDT is not simply “printed” from the thin air.

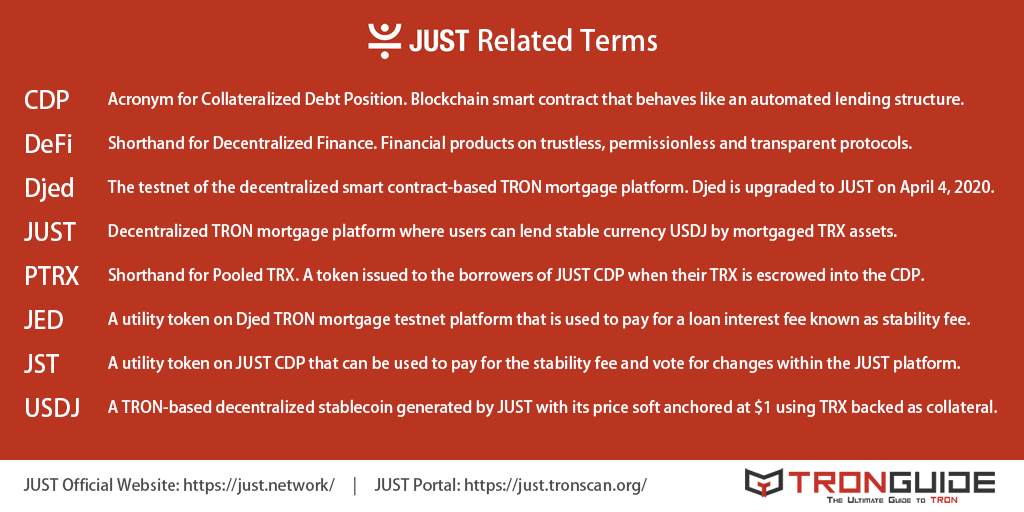

USDJ, on the other hand, is crypto-collateralized. The generation of USDJ is completely decentralized and the $1/USDJ value will retain stability through a series of aligned financial incentives. This movement that leverages decentralized networks to transform old financial products into trustless, permissionless and transparent protocols is known as Decentralized Finance, or DeFi for short.

What is Djed CDP?

Djed is the project name for TRON’s DeFi project while it was on the testnet (test network) stage. Djed allows users to get a loan by borrowing USDJ to users that use their TRX as collateral.

What is JUST?

On April 4, 2020, Djed CDP has been upgraded and it is renamed to JUST CDP. JUST foundation stated that their JUST CDP emphasis on creating a fair and just platform hence the name of the project.

When you want to get a loan from JUST, you [glossary_exclude]open[/glossary_exclude] a CDP (Collateralized Debt Position). In laymen’s terms, it’s like opening a loan account where you put up your TRX assets as collateral in order to take out a loan of USDJ. JUST CDP is a smart contract that runs on TRON blockchain. Since the CDP system is on smart contract, you don’t need to wait for the bank’s approval, or worried about bias bankers that do not want to give out a loan. As [glossary_exclude]long[/glossary_exclude] as you met the requirements set by the CDP system, you will be qualified to get a loan. The only current requirement to get a loan is to deposit a minimum of 100TRX as collateral.

How to get USDJ?

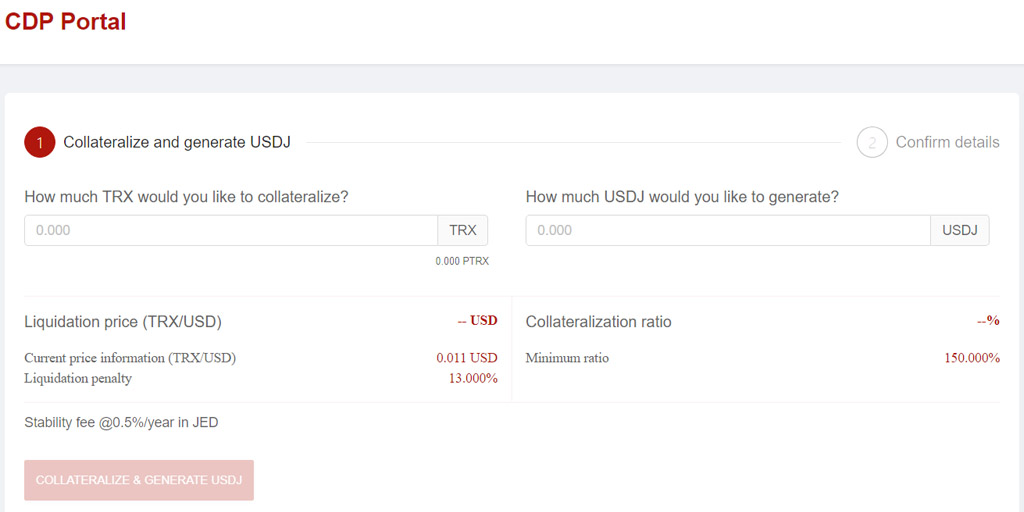

When you [glossary_exclude]open[/glossary_exclude] a CDP at https://just.tronscan.org/#/home you will need to decide how much TRX you wish to collateralize (to be locked up as a security). Let’s say you wish to collateralize 100,000TRX and the market value of TRX is $0.011 each, the maximum USDJ you can borrow is 733.33.

You may be wondering why your 100,000 x $0.011=$1100 worth of TRX can only get you $733.33 worth of USDJ, the reason is simple – Since the collateralized TRX is susceptible to market volatility, to ensure that the USDJ borrowed out does not worth less than the secured amount, the minimum collateralized ratio you need to maintain is 150%. Therefore, take the total value of your collateralized asset $1100 and divide it by 150% and you will get the maximum USDJ value you can borrow ($733.33).

What’s PTRX?

Do note that when you [glossary_exclude]open[/glossary_exclude] a CDP and collateralized your TRX, your TRX is not instantaneously converted to USDJ. Your TRX is actually converted to PTRX first. Therefore, PTRX (and not TRX) is actually the only collateral asset accepted by the JUST system at the moment.

PTRX stands for Pooled TRX and it functions as an emergency mechanism. If there is a sudden market crash in TRX, and the JUST CDP ends up containing more debt than the value of its collateral, the JUST platform will automatically dilute the PTRX to recapitalize the system. This means that the proportional claim of each PTRX goes down.

After PTRX is obtained, you can choose to withdraw the USDJ as [glossary_exclude]long[/glossary_exclude] as you maintain a minimum of 1.5:1 (collateral-to-debt) ratio.

How to get back the collateralized TRX?

To get back your TRX, you return the USDJ you have taken out + an interest fee which is called the stability fee. The stability fee is listed when you [glossary_exclude]open[/glossary_exclude] a CDP and it is currently set at 0.5%/year in JST.

What’s the difference between JST and JED?

Do take note that before April 4, 2020, the stability fee JST is referred to as JED while it was on the Djed test network. After Djed has been upgraded to JUST, the stability fee also changed from JED to JST. So, you most likely won’t have to bother with JED from now on since the testnet of Djed has been completed.

JST is a TRON-based token which you can get at an exchange or decentralized exchange later on. You can only pay back the stability fee using JST token. Once the USDJ and JST are paid back to the CDP, USDJ will be burned from the circulating supply and JST will be burned and remove from the total supply.

What’s JST for?

The total initial supply of JST is 9.9 billion. New JST can’t be created or mined anymore and the full amount of JST as the stability fee will be burnt by the JUST smart contract when a user returns it to the CDP. Other than serving as the stability fee, JST token holders are also considered the regulators of the JUST CDP.

Multiple parameters for risk-control to regulate the CDP are put up for vote and determined by JST holders. Some of the JUST governance actions include deciding the CDP’s debt ceiling, liquidation ratio, stability fee, penalty ratio, as well as other proposal contract related governance tasks. These parameters play an important role to keep the USDJ price stable by making the CDP more attractive to borrowers or making it more beneficial for existing borrowers to clear their debt.

Why USDJ?

You may be thinking, why would someone lock in $1100 worth of TRX + stability fees (currently set at 0.5%/year) in order to make a loan of $733.33 in USDJ. Won’t it be simpler for one to just exchange the $1100 worth of TRX to $1100 USDT directly? The answer is if you simply need the cash equivalent in USD and won’t be looking back into crypto for a while, exchanging your TRX into USDT and converting it back to fiat is the norm. However, most users of CDP tend to be bullish on crypto and believed that their collateral asset will appreciate over time. Therefore, it makes sense to secure their TRX so they won’t have to purchase it back at a higher price later.

A simple example could be if one was to sell-off his/her holdings of $1100 worth of TRX and plans to rebuy it a year later, if the price of TRX has doubled and reached $0.022, the person can only repurchase half of what he/she had before (i.e 50,000TRX instead of 100,000TRX). If the person opened a CDP and take out $733.33 worth of USDJ as a loan, a year later, he/she will only have to pay back $733.33 worth of USDJ and $3.6759 worth of JST as the 0.5% stability fee. The person is free to use the $733.33 USDJ in any way during the loan period and after the CDP is paid to the position and closed, he/she can still get back the escrowed 100,000TRX, which will be worth $2200 if TRX price doubled in a year.

What’s the catch?

This seems too good to be true, what’s the catch? The catch is never to stick with the minimum 150% collateralized ratio. The reason is because if your collateralized TRX drops in value and hits below the 150% collateralized ratio, your CDP may get liquidated.

In the financial world, to liquidate something means to sell an asset for cash. In the crypto world, liquidation is the process of selling user’s collateral to cover the user’s generated USDJ. JUST liquidates the CDPs by auctioning off the TRX locked up inside it before it becomes less than the amount of USDJ getting backed by it. When liquidation occurs, you will also need to pay back a liquidation penalty fee (currently set at 13%). The penalty will be taken out from your collateralized TRX so you will get less TRX when you cleared your debt.

Therefore, the primary risk to CDP owners is maintaining a safe leveraged position in a highly unpredictable market. To secure your position, the amount you have borrowed must always be worth significantly less than the amount you have staked. In our example, for $1100 worth of TRX, you may choose to take out only $550 worth of USDJ and you will have your collateralized ratio at 200% (1:2). If your CDP is [glossary_exclude]close[/glossary_exclude] to the liquidation price, you can either add more collateral by adding more TRX into the CDP or return some USDJ to reduce the risk of liquidation. You can always check your updated collateralized ratio in your JUST portal once you opened a CDP.

Another catch is related to the stability fee. Some may notice that 0.5% of 733.33 should be 3.6667 instead of 3.6759 that we stated earlier. Due to the highly variable lifetime of CDPs (i.e people may choose to settle their CDP anytime they wished), the stability fee is compound continuously instead of doing a single annual compound. The formula for the continuous compound is as follows:

Borrowed amount × 2.7183 ^ (Stability Fee%) – Borrowed amount

Therefore, the calculation for 0.5% stability fee based on our example is:

733.33 × 2.7183 ^ (0.5%) – 733.33 = 3.6759

Do also note that the JUST stability fee is not fixed at 0.5%/year. Holders of JST can vote for stability fee changes depending on if they want to attract more people to [glossary_exclude]open[/glossary_exclude] CDP or closes CDP. Therefore, keep an eye on the stability fee if you decided to [glossary_exclude]open[/glossary_exclude] a CDP.

We hope this guide explains the basics you need to know about TRON’s JUST CDP. As always, do not take this as a piece of financial advice. You should only invest in the amount that you are comfortable with and always Do Your Own Research (DYOR). If you find this guide useful, feel free to share it with anyone else!